By Rayan Malhotra

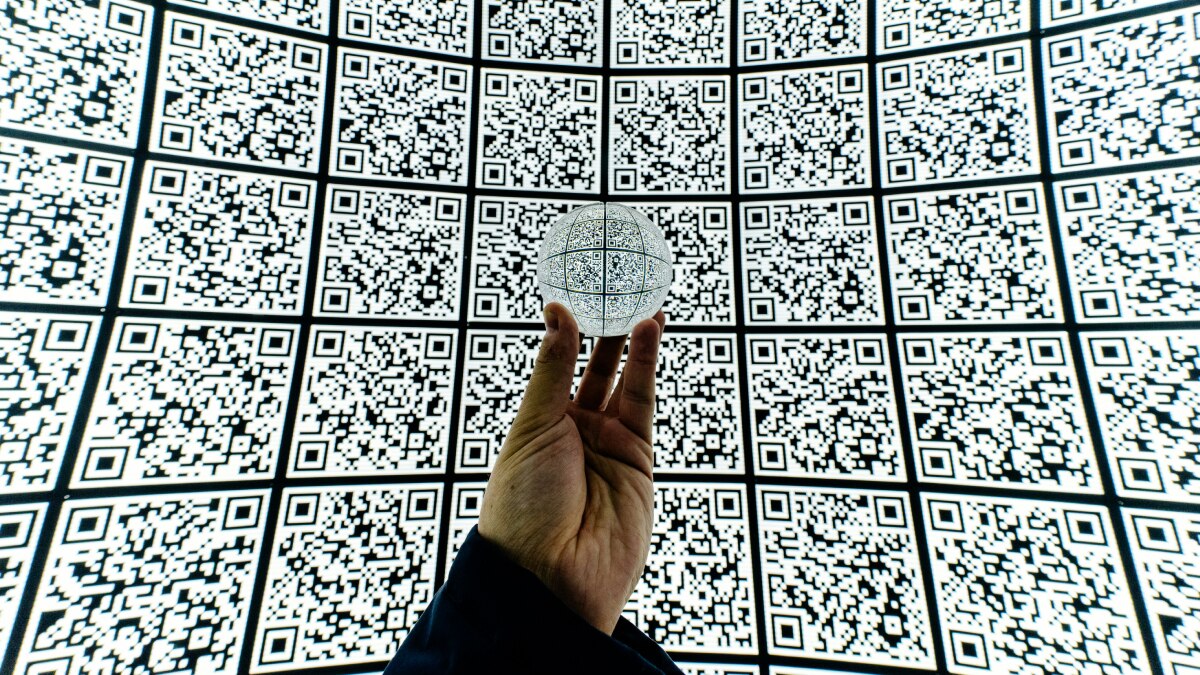

Over the decades, India’s economy has transformed from a coin-based to a tech-savvy society. QR code transactions revolutionised payments, significantly impacting rural and urban life and integrating them into governance. This article explores the rise of QR payments in India and its driving factors, challenges, and prospects.

From Cash To QR Codes

Traditionally, India was once a cash-based economy. Cash transactions become millions of people’s preferred way of payment due to their convenience and familiarity. Yet, the digital revolution opened new potential for development in the payments sector. Originally used to track inventories, QR codes rapidly found a new purpose in facilitating speedy and efficient financial transactions.

Rise Of Digital Payments

Digital payments in India have surged due to the government’s push for a cashless economy. Initiatives like Digital India and UPI have boosted adoption. QR codes have become an effective tool, allowing users to transfer money by scanning with their smartphones, reducing the need for cash or physical interaction.

Demonetisation Of Money

Demonetisation on November 8, 2016, invalidated high-denomination currency, sparking demand for alternative payment methods. This led to increased use of e-wallets and QR code payments, showcasing the adaptability of digital systems and paving the way for widespread adoption.

Benefits Of QR Payment In India

Bridging the urban-rural division:

- Urban regions with high smartphones and internet penetration make embracing QR code payments easier.

- Rural communities, typically lagging in technology adoption, have accepted QR code payments thanks to government efforts and financial inclusion programs.

- QR codes provide an inexpensive, simple-to-use alternative that requires no sophisticated structures, making them available even in rural areas of the country.

Governance and Citizen Services:

- QR codes are integrated into governance, streamlining processes and reducing corruption.

- They generate e-challans for traffic violations, pay utility bills, and access public distribution systems.

- This integration makes essential services more accessible to the general populace.

Interoperability:

- Systems like Bharat QR allow transactions across different banks and payment platforms.

- Users do not need multiple apps for different services, enhancing convenience.

- This seamless integration fosters a unified digital payments ecosystem.

Identification and Authentication:

- QR codes are used for secure identification and authentication purposes.

- Aadhaar-enabled payment systems utilise QR codes to authenticate users, ensuring secure transactions.

- QR codes function as payment facilitators and authentication tools, highlighting their versatility.

Ubiquity in Everyday Life:

- QR codes are prevalent in everyday transactions, from street vendors to high-end retailers.

- They signify a shift towards a more digital economy.

- Typical uses include buying groceries, paying for cab rides, and donating to temples.

QR Payment Challenges

Despite their numerous advantages, QR code payments face several challenges in India:

- Digital Literacy: Basic digital literacy is still lacking in many Indians. It is essential to teach customers how to scan QR codes and ensure they know the security risks associated with online transactions.

- Security Concerns: QR codes are vulnerable to fraud due to their static nature and ease of replication. Fraudulent actors may substitute authentic codes with fake ones, resulting in unauthorised transactions. Therefore, it is imperative to guarantee the secure production and validation of QR codes.

- Infrastructure Limitations: In semi-urban and rural settings, erratic internet access might make it difficult for QR code payments to be processed smoothly. Network infrastructure upgrades are essential to the general acceptance of digital payments.

- Interoperability Issues: Despite the latter’s notable advancements, only some QR code payment systems are compatible with UPI. Creating uniform QR code formats for various payment providers can improve user experience and minimise ambiguity.

- Merchant Adoption: To persuade small business owners to switch from cash to digital payments, they must ease their worries about transaction costs, settlement times, and the alleged complexity of digital systems.

Addressing The Challenges

To overcome these challenges, a multi-faceted approach is required:

- Education and Awareness Campaigns: Public and private sector initiatives should inform consumers and retailers about the advantages of QR code payments and the precautions they should take to protect them.

- Enhanced Security Measures: You may reduce the risk of fraud by using dynamic QR codes that update every transaction and encrypt data.

- Infrastructure Development: The development of digital payments depends on extending internet access and guaranteeing dependable network coverage in outlying locations.

- Standardisation and Interoperability: Creating and promoting a uniform QR code format across all payment platforms will simplify users’ and merchants’ transactions.

- Encouraging Adoption: You can encourage more merchants to accept QR code payments by providing incentives like lowered transaction fees and quicker settlement times.

QR code payments can transform India’s payment landscape, making transactions faster, easier, and more accessible. By addressing the challenges of digital literacy, security, infrastructure, interoperability, and merchant adoption, we can ensure that QR code payments become a cornerstone of India’s digital economy.

(The author is the CEO of NeoFinity, a FinTech company)

Disclaimer: The opinions, beliefs, and views expressed by the various authors and forum participants on this website are personal and do not reflect the opinions, beliefs, and views of ABP Network Pvt. Ltd.